As expected, the UKGC biannual statistics dropped at the close of May. The report published in May and November covers the period starting from October 2018 to September 2019. This was just before the global pandemic touched down in the UK. However, the effects of the pandemic will likely feature at length in the November report.

The latest six-month report comes with an ocean of data, considering how big the United kingdom’s gambling industry is. While the info on this report may be monstrous to cover in a single post, we’ll focus on the main highlights touching on the online gambling and land-based spaces.

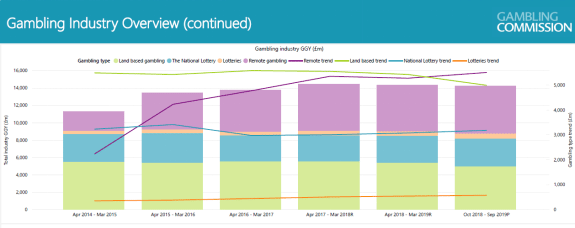

Retail Gaming on the Decline, Online Gambling on the Rise

According to the data in the UKGC biannual report, the number of retail shops saw a 12.1% decline between March 2019 and October 2019. This brought the number of premises to 7,315 in September 2019.

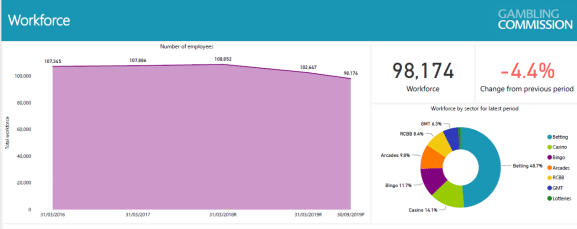

The closure of the shops stems from the imposed measures that sought to reduce the betting limits for Fixed Odds Betting Terminals (FOBTs). This move aimed at promoting responsible gambling but numbers don’t lie. A 4.4% decline in employment opportunities following the closure of these shops means thousands of people (98,174) have to seek new income sources.

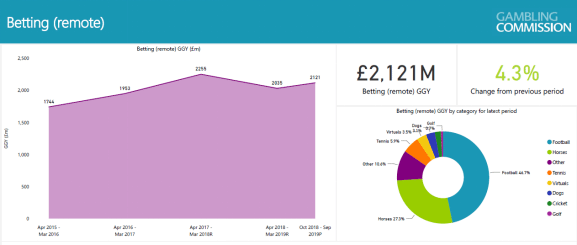

As land-based operators took the biggest hit, the iGaming industry saw a steady rise. This is thanks to advancements in mobile technology experienced over the past few years. The report shows a 4.3% rise to set the revenues at £2.1 billion from £2.0338 billion.

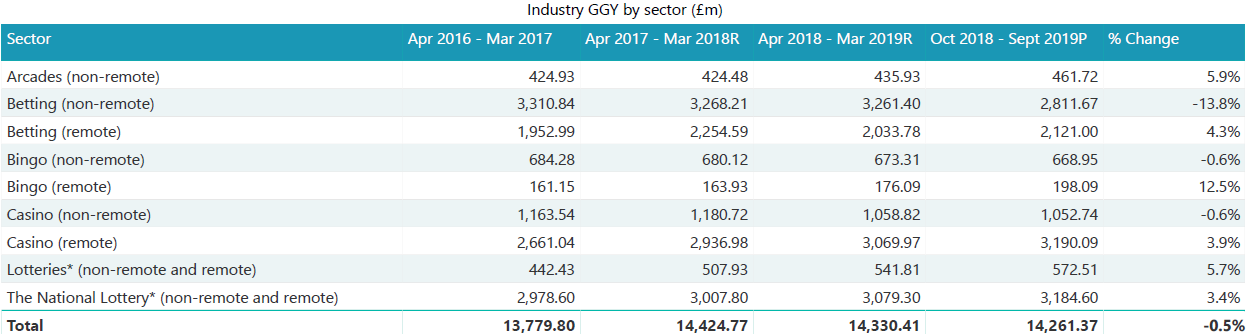

A notable mention here is the increase in the remote bingo GGY settling at £198 million, marking an impressive 12.5% increase to stand at £198.1m from £176.1m. This is for periods between April 2018 – March 2019 and October 2018 – September 2019. Remote casinos also contributed a fair share of the revenues with an increase of 3.9% to stand at £3.2 billion.

Contributions to Good Causes and Total GGY

Also included in the report by UKGC were the contributions by the National Lottery toward good causes. The figure here stood at £1.6 billion representing a 6.5% increase. Large society lotteries posted a 3.7% increase in overall revenues to close at £345m.

As a result of the new FOBT rules that reduced maximum stakes from £100 to £2, GGY for B2 machines took a massive hit with a 46.4% decline posted in the period between April 2018 – March 2019 to close at £624 million. Category B3 machines, on the other hand, posted £1.3bn in revenues displaying an 18.5% increase for the period between October 2018 and September 2019.

The overall GGY for gaming machines excluding those requiring permission from a local authority took a nosedive of 11.8% to close at £2.5 billion.

When it comes to the overall GGY for the entire gambling industry in Great Britain, the total stood at £14.3bn representing a 0.5% decrease. These figures take a further beating after withdrawing figures from the lotteries. The new figure stands at £10.5 billion, representing an overall 1.9% decrease

What to Expect

As the COVID-19 pandemic continues to shatter economies around the world, it’s obvious that the gambling industry in the UK will continue in the same trend as depicted in this report. The retail gambling space will continue plummeting due to movement restrictions while online gambling will rise due to increased home-based activities. Having said that, the November report will shed more light on how the industry fared during these unprecedented times.